| |

|

|

Direct Tax Consultancy |

| |

| Direct tax consultancy together with innovative tax efficient strategies, provided by us form an integral part of viable business decisions. These help our clients attain the desired goals. We adopt a “result oriented approach†which is flexible and emphasizes delivery and value. It enhances the effect of commercially viable decisions and minimizes the tax burden.

Assessment (audit by tax authorities) and appeals. |

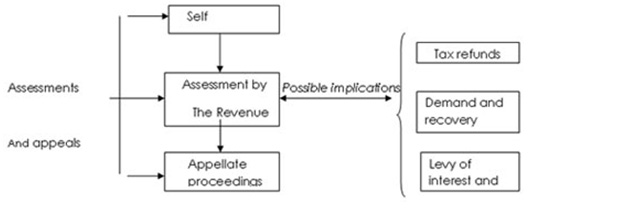

| The assessment and appeals procedure under the Act involves the following: |

|

| Self-Assessment |

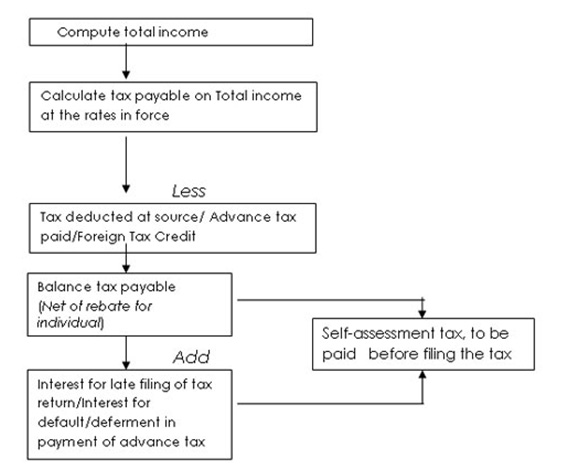

| Every assessee, before submitting a tax return, is required to make a self-assessment of income and after taking into account the amount of tax already paid by way of TDS and advance tax, pays the balance tax (self-assessment tax) due on the income. Further, along with the tax, any interest arising on account of delay in furnishing of tax return or any default /deferment in payment of advance tax, is also required to be paid. The procedure for self-assessment and determination of tax liability has been depicted below by way of a flowchart. |

|

| |

|

|

|

|

|